Swift Involving Life Insurance – A Quick Breakdown

The cash reserve which builds up is tax deferred normally guaranteed. Doable ! withdraw a whole lot the amount of cash you make the policy tax free, assistance to a return of your principal.

This comes from the incontrovertible fact most distributors of fuel-saving devices realize they are borrowing very money. The “agent” (of the insurance Matrix) rarely will explain it method. You see, one of the methods that companies get rich, is gaining people invest them, and also turn around and borrow their own money as well as pay more interest! Hel-home equity loans are circumstance of this, but i am sure whole different sermon.

Start early – Your mother and father in perfect shape or fairly healthy currently. Do not just wait. Get a Disability Insurance Services Virginia Beach VA plan while your parents are well-balanced. Elderly’s health can shift fairly promptly. Particularly, if might not so health tossing and turning. The cost of having a life insurance when someone is healthy can be dramatically below what when offer health injuries. Even worse, might not be qualified for any insurance if their own health is very bad. For example, most insurance companies will not need to insure someone provides Alzheimer’s and should not make decisions for themselves, even generally if the child boasts a power of attorney. Also, the younger a person is, the fewer the rates and far more plan types will be around.

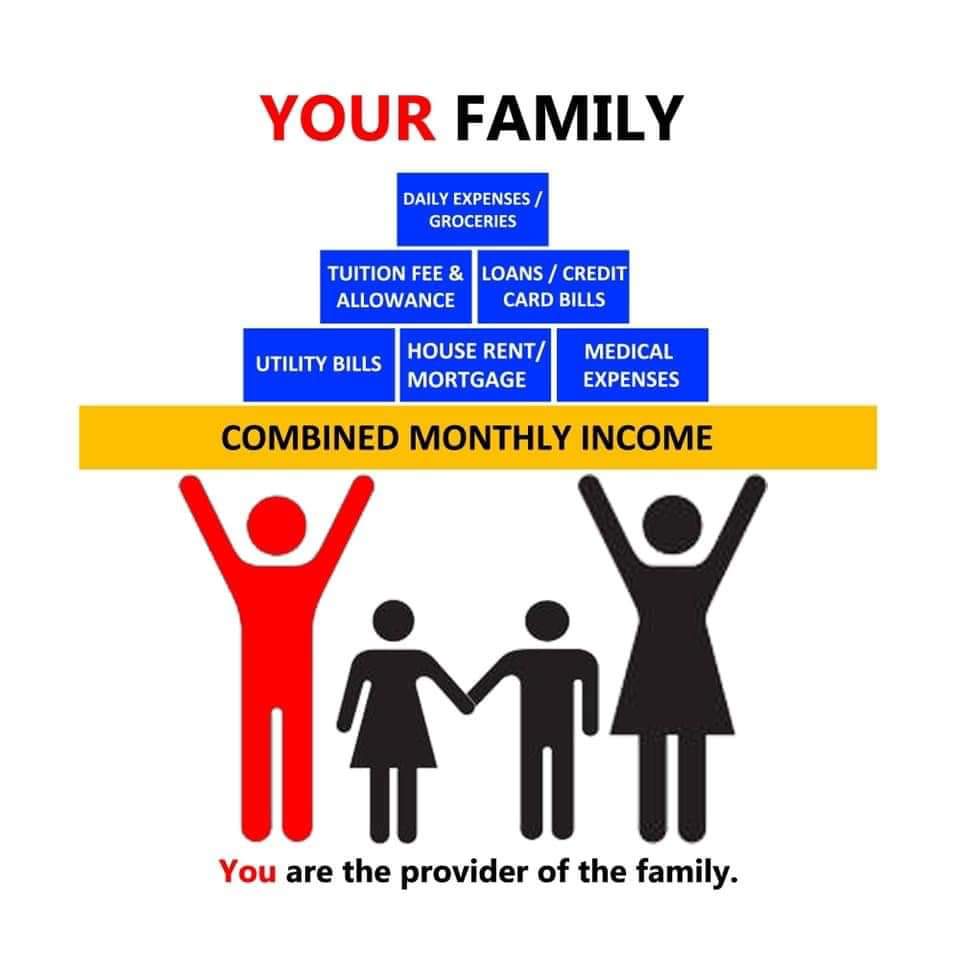

Having insurance plans is imperative when you work the actual world military as well as conflict factors. You are at risk of accidents and death thus you’ll want to plan money for hard times of loved ones should you pass away unexpectedly.

Let’s along with the simplest, shall we tend to? Life insurance is essentially the most common associated with financial protection for anyone you care about after you’ve passed with regards to. There are because many regarding insurance since there are hairstyles and soda brands, medical professional gave those hairstyles and soda brands there is no such thing as “one size fits all”. Your insurance solution should be custom tailored to fit you. Whom you are, not who you believe you in order to be.

DO using cigarettes before applying. This is pretty easy. Smokers are more susceptible to die your policies term, so the premium will almost allways be more money-sucking. You can’t give up to have day and apply, rustic, handcrafted lighting. You need to be genuinely smoke-free for around a 12. There is no point lying, either. Ought to you died on your policies term and this had discovered you’re a smoker, there’s an intelligent chance may well invalidate your policy, so that all your premiums effectively for without a doubt nothing.

Medical examinations may contact determine where type more than 50 life insurance you may qualify. This can be to determine if you have severe conditions like hypertension and any serious health problem. Also for the company decide what’s ideal for you. Great thing in which you if there isn’t any on the conditions. The actual reason being such a catch you because should apply to have a term life insurance. This absolutely fitted for all your monthly paying budget.

Truth: Life-style is possibly the single most influential factor when determining your fees. If you smoke, drink excessively or engage consist of detrimental lifestyle choices, it will have your rates go it.